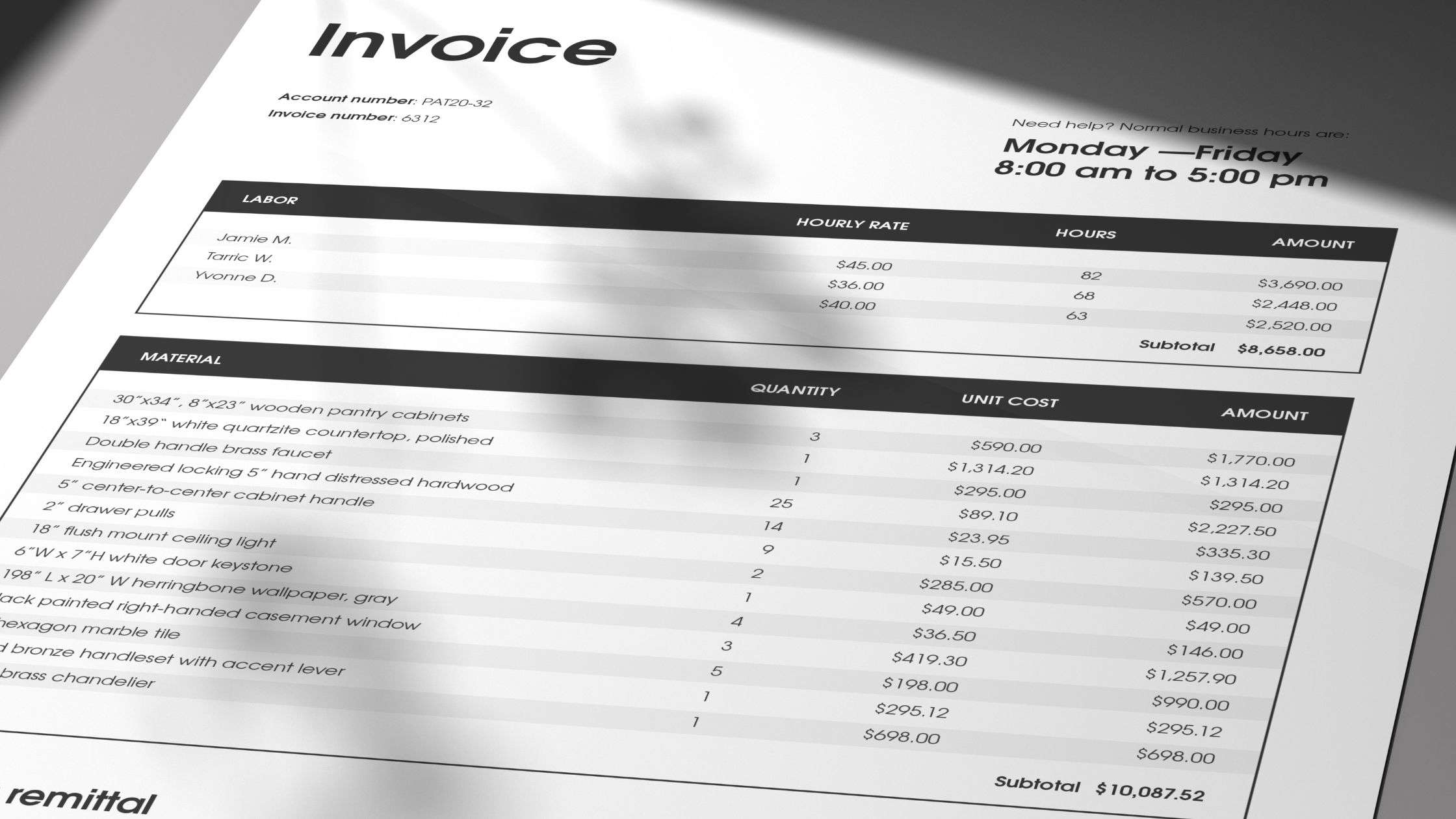

Payroll Pitfalls to Avoid in 2026 — And How a Reliable Payroll Service Makes It Easy

Like Odysseus navigating shifting seas, you face 2026 payroll risks that can quietly sink budgets and trust. You’re juggling new regulations, worker classification, cross‑border pay,